tax strategies for high-income earners 2020

In this blog we will discuss tax withholdings maximizing. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

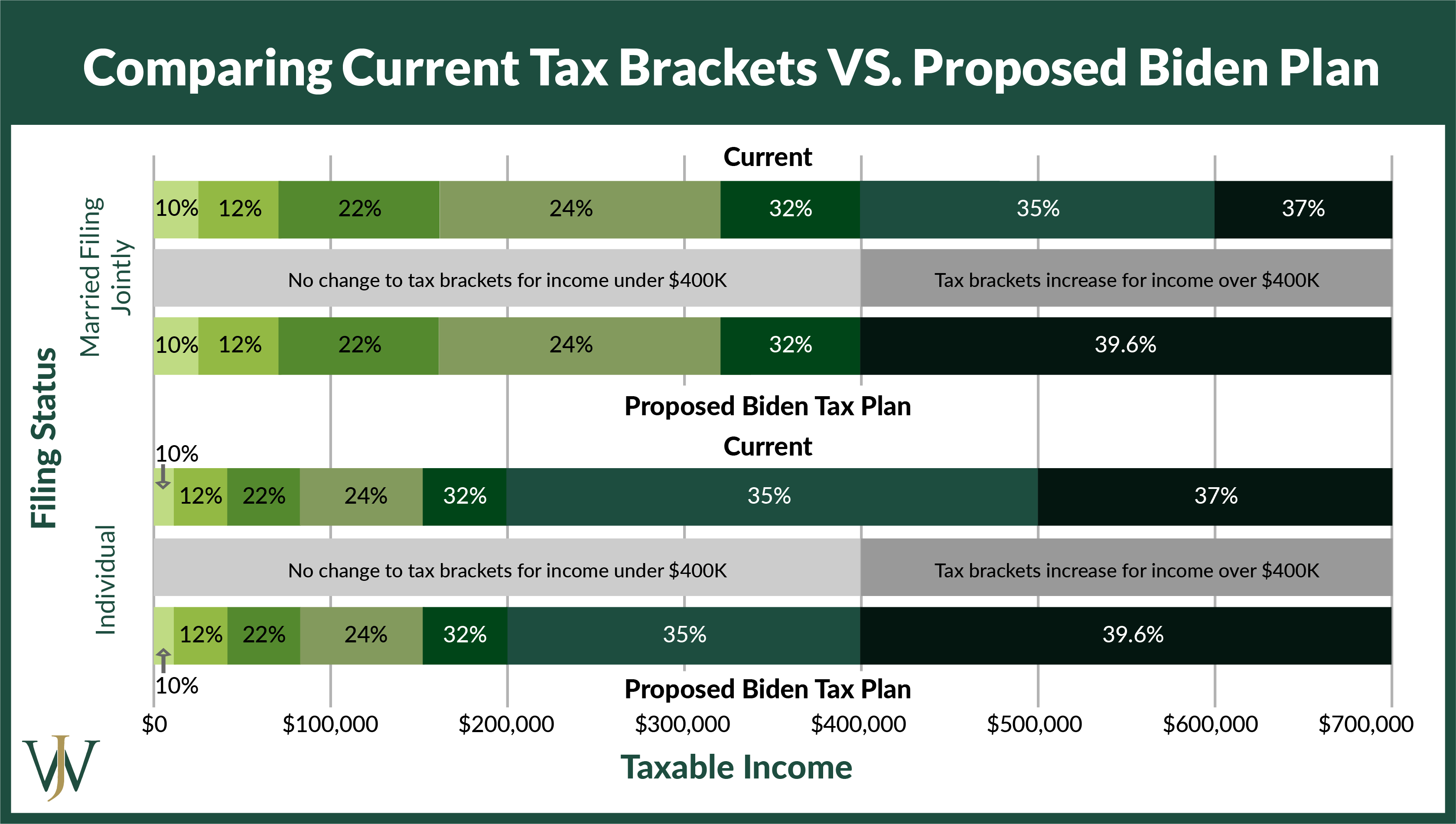

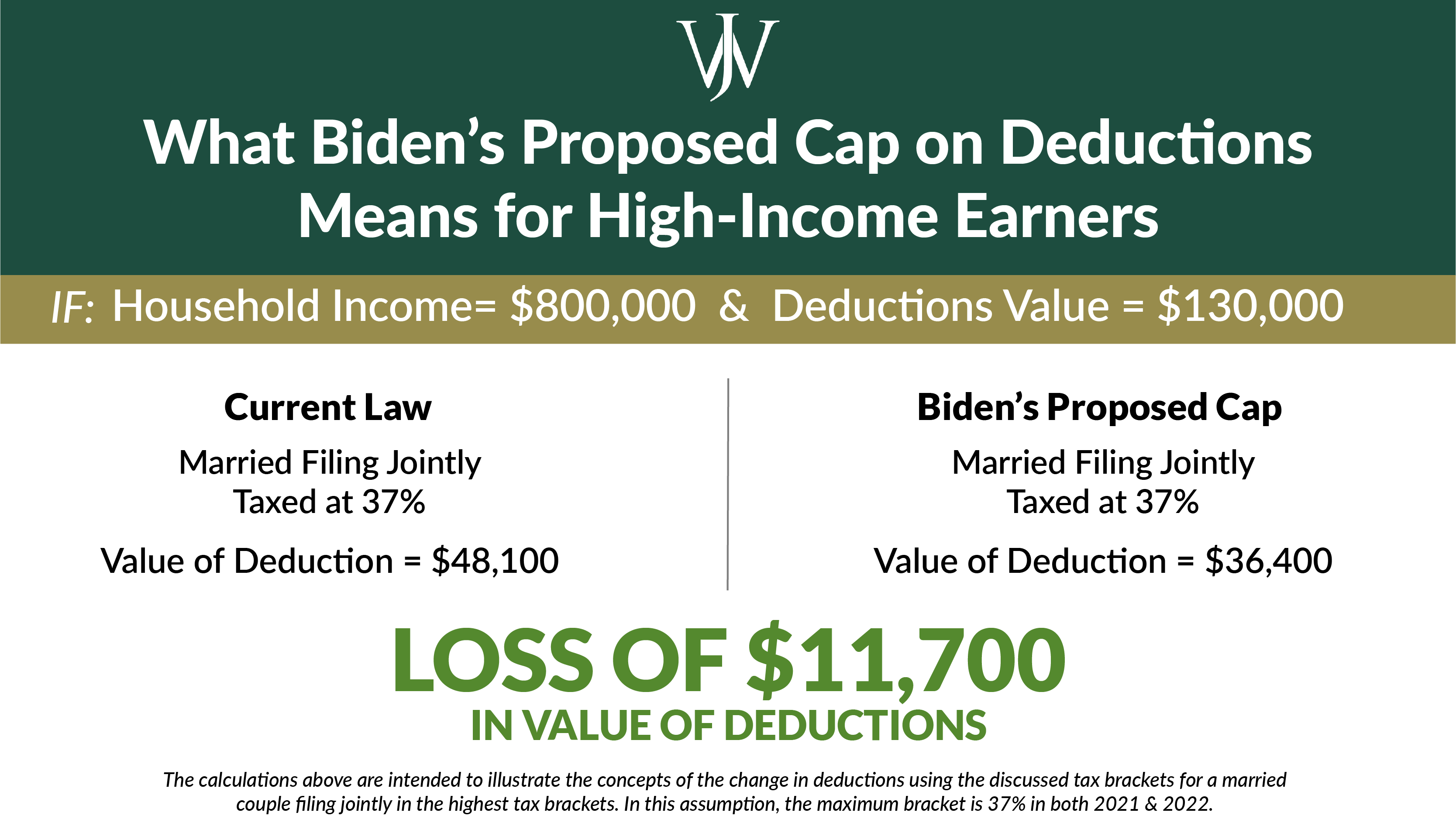

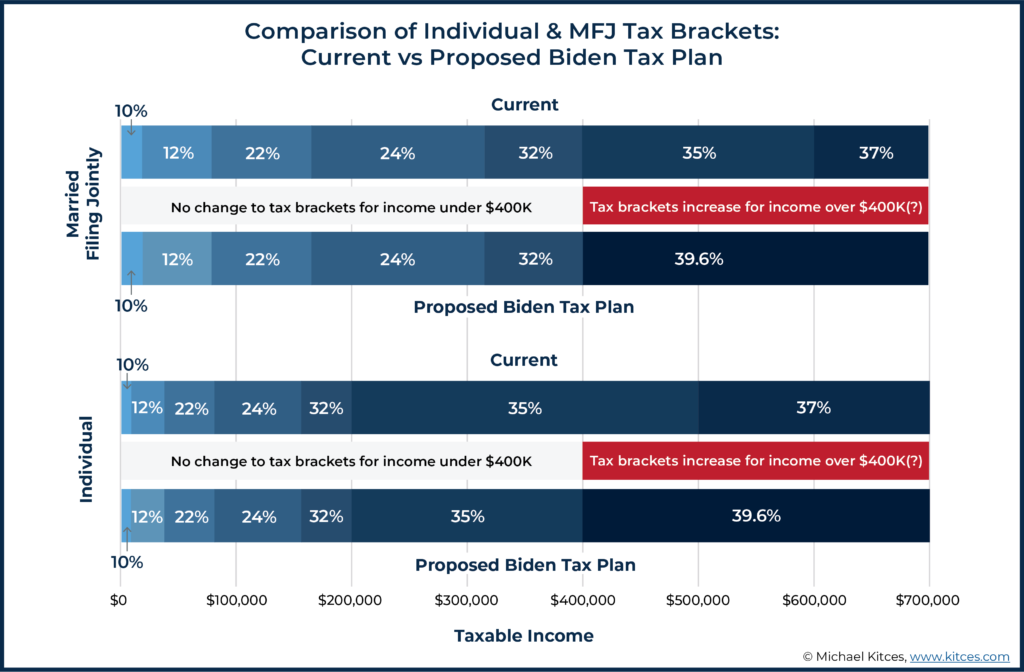

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

Max Out Retirement Accounts and Employee Benefits.

. Health Savings Account Investing. Now may be an excellent time to purchase a home or opt for a cash-out refinance. We provide guidance at critical junctures in your personal and professional life.

Opening a Solo 401K is Among the Important Tax Saving Strategies for High Income Earners. Ad Tax Strategies that move you closer to your financial goals and objectives. In 2020 you can.

The 2022 annual limit is 20500. 9 Ways for High Earners to Reduce Taxable Income 2022 1. July 24 2020 225242.

Tax laws change often and increasing complexity makes it hard to stay on top of the latest tax saving strategies for high income earners. How to Reduce Taxable Income. Read customer reviews find best sellers.

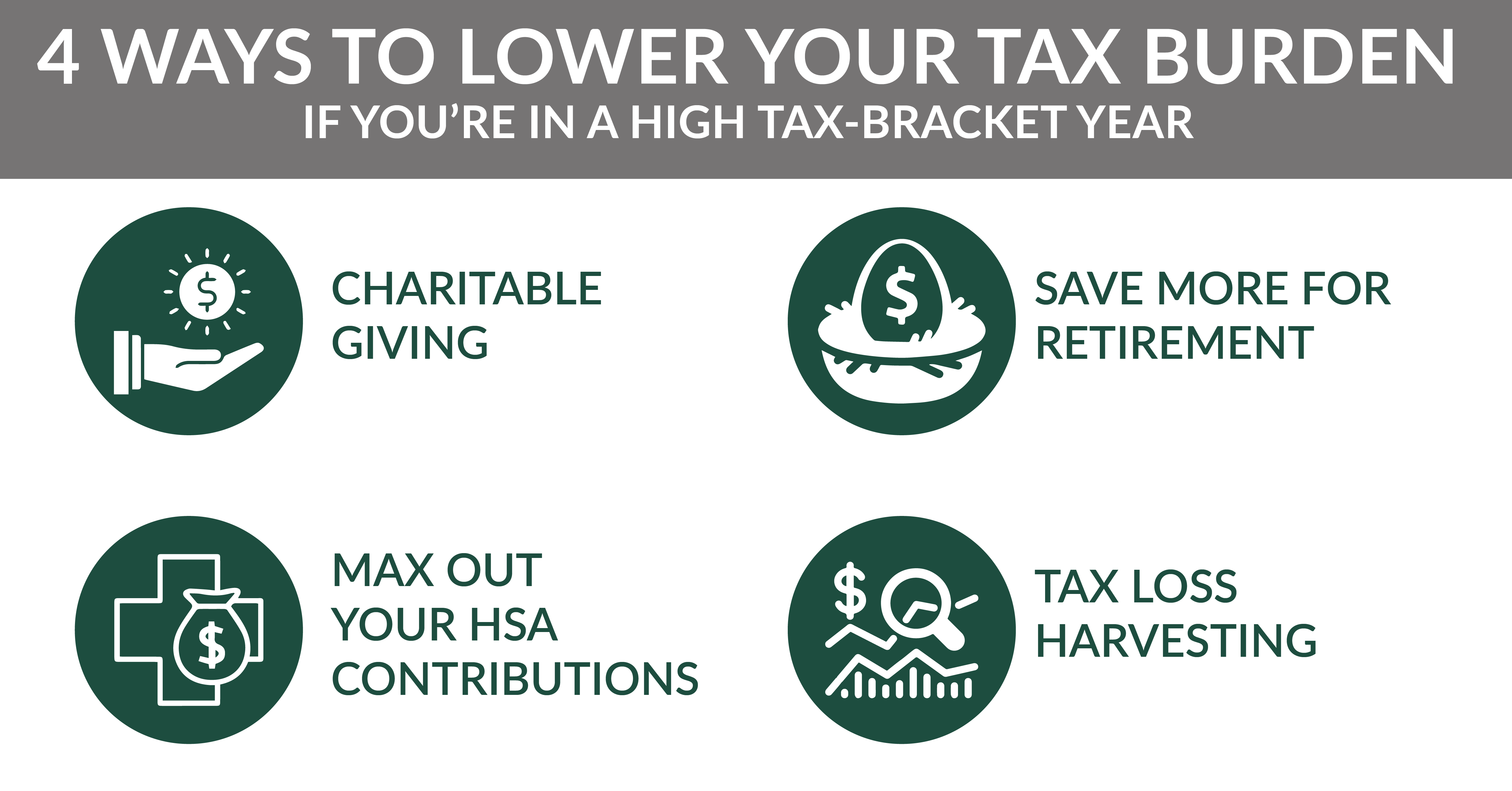

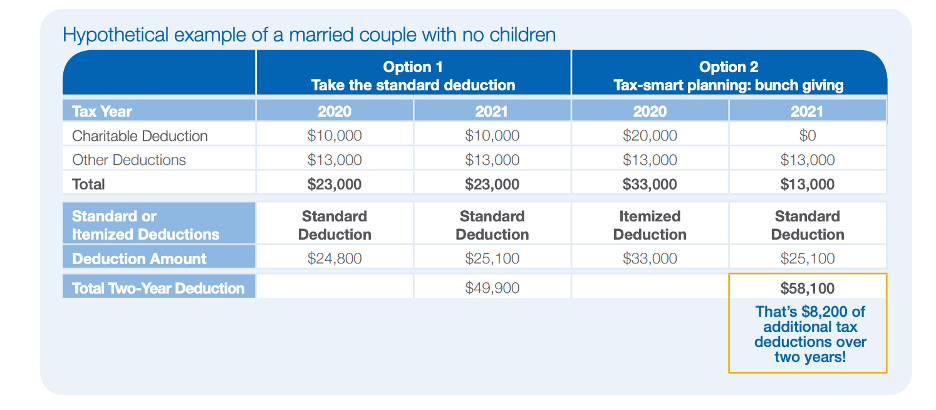

One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. With a CRT high-income earners and small.

The law permits you to deduct the amount you deposit into a tax-certified. 6 Tax Strategies for High Net Worth Individuals. Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners.

1 Ad Make Tax-Smart Investing Part. Lets make sure you have the know-how to implement these year-end tax strategies made especially for high-income earners. A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT.

If your work or assets generate. Build Your Team of Professionals You might build a. Browse discover thousands of brands.

For example a single taxpayer earning up to 9950 will pay around 10 of their taxable income. Thankfully there are some tax strategies for high income earners you can do now to keep from overpaying this tax season. We cant talk about tax strategies for high-income earners without mentioning real estate.

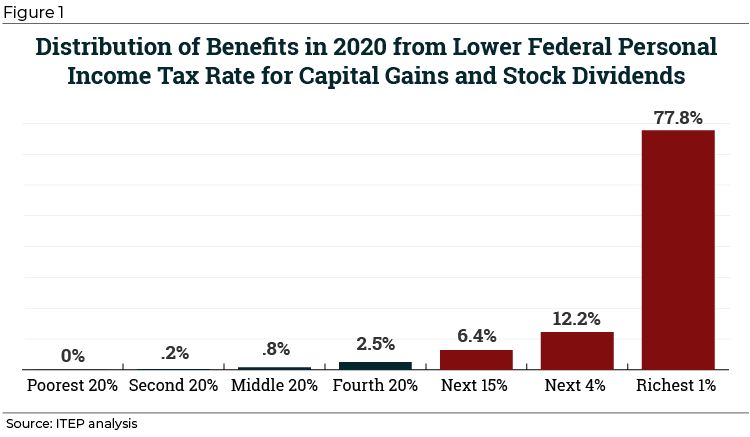

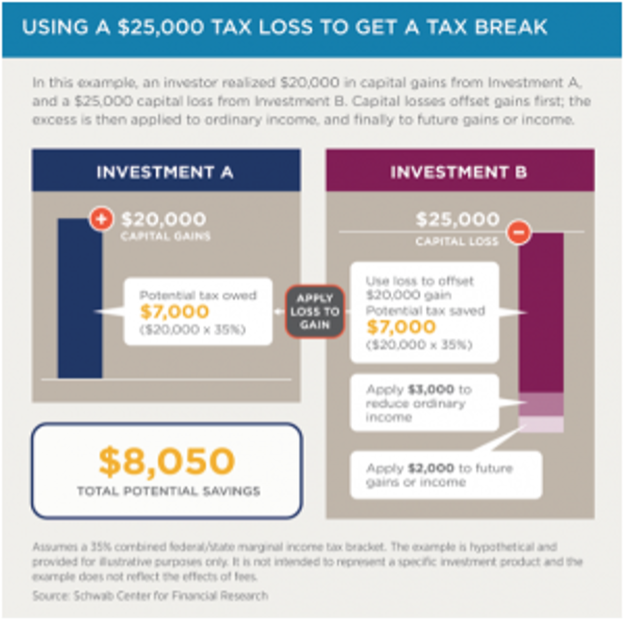

When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden. Managing the timing of substantial gains to avoid being subject to the Medicare surtax or being pushed into the 20 percent capital gains bracket should be a part of effective tax strategy for. Other than the reality you need a comfortable retirement putting resources into particular kinds of retirement accounts is one the best tax strategies for high income earners.

In this article well look at the most common types of tax strategies for high-income earners and how you can make the most use of them. If you wish to save tax. A donor-advised fund DAF is an investment account created to.

However if that single person earns more than 523600 that year they will pay taxes of 37. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Third you reduce your tax burden because the money goes straight to a charity so it does not appear as income on your tax return.

Learn More At AARP. Creating retirement accounts is one of the great tax reduction strategies for high income earners. Max Out Your Retirement Contributions.

Use a Health Savings Account HSA Photo by. Lets start with retirement accounts.

5 Outstanding Tax Strategies For High Income Earners

Proposed Tax Changes For High Income Individuals Ey Us

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

5 Outstanding Tax Strategies For High Income Earners

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Budget 2020 Dividend Distribution Tax Scrapped But Shifts The Burden To The Recipients High Income Earners To Bear Th Dividend Higher Income Dividend Income

What You Need To Know About 2020 Taxes Advisors Management Group

Understanding The Mega Backdoor Roth Ira Roth Ira Personal Finance Budget Roth

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

14 Tax Tips For The Self Employed Taxact Blog

Biden Tax Plan And 2020 Year End Planning Opportunities

6 Strategies To Reduce Taxable Income For High Earners

15 Best Weekend Jobs To Make Extra Money 50 Hour

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

Astute Savers Don T Just Use 529 Plans For College Savings

Amazon Com Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes 1 9781734792607 Mackwani Adil N Books

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners Wiser Wealth Management