kern county property tax due

On Friday December 10. Ten percent penalty is added to delinquent first installments on December 10 at 500 pm.

Kern County Treasurer And Tax Collector

First installment is due.

. Crime Non-Emergency Domestic Violence. 10 according to a press release from Jordan Kaufman the countys treasurer and tax collector. To avoid a 10 late penalty property tax payments must be.

The first installment becomes due and payable on November 1 each year and delinquent on December 10 at 500 pm. KGET The Kern County Treasurer and Tax Collector KCTTC is reminding Kern residents that the first installment of property tax is due next week. Such As Deeds Liens Property Tax More.

Property Taxes - Pay by Wire. Please enable cookies for this site. Cookies need to be enabled to alert you of status changes on this website.

Please type the text from the image. Senate Bill 813 enacted on July 1 1983 amended the California Revenue and Taxation Code to create what are known as Supplemental Assessments. Child Abuse or Neglect.

10 or it will become delinquent. When paying by mail include the payment stubs with your check. Fraud Waste and Abuse in Kern County Government.

Please select your browser below to view instructions. Start Your Homeowner Search Today. Supplemental Assessments Supplemental Tax Bills.

Ad Need Property Records For Properties In Kern County. Kern County CA Home Menu. Various methods of payment are available.

KERO Kern County Treasurer and Tax Collector said that the first installment of Kern County property tax will become delinquent if not paid by 5 pm. Look Up Property Records. Proposition 13 - Article 13A Section 2 enacted in 1978 forms the basis for the current property tax laws.

Kern County real property taxes are due by 5 pm. A ten percent penalty is added to delinquent first installments on December 10th at 500 PM. PAYMENT OF TAXES DUE DATES Taxes become a lien on all real property on the first day of January at 1201 am.

KERO The first round of property taxes is due by 5 pm. PAYMENT OF TAXES DUE DATES Taxes become a lien on all real property on the first day of January at 1201 AM. If the due date falls on a Saturday Sunday or legal holiday the hour of delinquency is 5 oclock on the next business day.

Kern County - Property Tax Deadline Extension April 2020 Author. A 10 penalty is added as of 500 pm. Last day to file property tax exemptions.

Taxpayers may inquire or make payments on their property taxes in person by mail or via the Internet. KCTTC PO Box 541004 Los Angeles. See detailed property tax information from the sample report for 10804 Thunder Falls Ave Kern County CA.

First installment payment deadline. Kern County collects on average 08 of a propertys assessed fair market value as property tax. A 10 penalty is.

Treasurer-Tax Collector mails out original secured property tax bills. The first installment is due on 1st November with a payment deadline on 10th December. The Kern County treasurer and tax collector is warning people not to be late otherwise a 10 percent fee.

Second installment due. This figure is multiplied by the effective tax levy ie. They range from the county to city school district and various special purpose entities such as sewage treatment plants water.

If any of these payment or filing deadlines fall on a weekend or holiday the due date is the first business day following that weekendholiday. Start Your Kern County Property Research Here. As COVID-19 is still prevalent in the.

Kern County California Property Tax Go To Different County 174600 Avg. The sum of all applicable governmental taxing-delegated units rates. The county agency is urging residents to make sure they pay the first installment of their property tax by 5 pm.

Taxes are due November 1st and Feburary 1st and will become delinquent on December 10th and April 10th at 5 oclock PM. 08 of home value Yearly median tax in Kern County The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Search Valuable Data On A Property.

This law requires that any increase or decrease in assessed value due to a change in ownership or completed new construction becomes effective. If a delinquent date falls on a weekend or holiday the delinquent date is the next business day February 1. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

Ad Get In-Depth Property Tax Data In Minutes. Dec 8 2021. Press enter or click to play code.

Secured tax bills are paid in two installments. Property Taxes - Pay Online. 1 Via mail to.

The first installment becomes due and payable on November 1st each year and delinquent on December 10th at 500 PM. Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year.

Home Water Association Of Kern County

Kern County Treasurer And Tax Collector

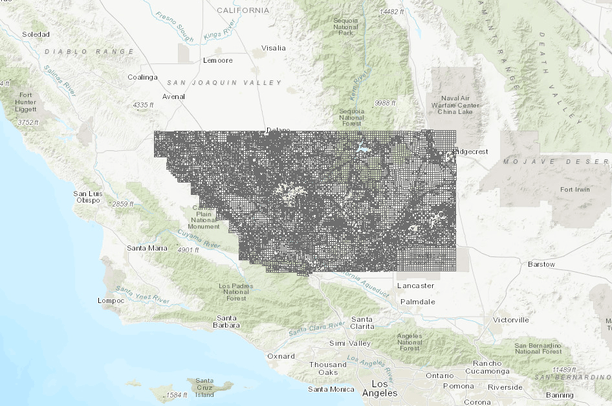

Oil Gas Play Key Role For Kern County Public Finances Energy Duke Edu

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector